Don’t just get a virtual office—let us help you build your business with our expert resources.Learn More

Startup Loan for New Business by Indian Government

Highlights:

-

- The Startup India scheme, launched in 2015, has helped drive significant growth in new Micro, Small & Medium Enterprises (MSMEs) in India.

- The Stand-Up India scheme, launched in 2016, aims to promote entrepreneurship among SC/ST and women by offering loans between Rs 10 lakh to Rs 1 crore per bank.

- Loans are offered at low interest rates starting from 8.50% by banks and NBFCs through this portal.

- The Pradhan Mantri MUDRA Yojana (PMMY) offers loans up to Rs 10 lakh without collateral at affordable interest rates.

Introduction

Starting a new business is a challenging yet rewarding journey. In India, entrepreneurs face various hurdles, including securing the necessary funds to bring their ideas to life.

Recognizing the critical role startups play in economic growth and job creation, the Indian government has introduced several loan schemes specifically designed to support new businesses.

This blog delves into the details of these startup loans, exploring the options available, eligibility criteria, application process, and benefits.

Understanding the Need for Startup Loans in India

Starting a business involves numerous expenses, from acquiring equipment and inventory to covering operational costs and marketing.

For many aspiring entrepreneurs, access to capital is a significant barrier. Traditional lending institutions often hesitate to provide loans to new businesses due to the perceived risks.

This is where government-backed startup loans come into play, offering financial assistance with favorable terms to encourage innovation and entrepreneurship.

Key Government Schemes for Startup Loans in India

The Indian government has launched several schemes to facilitate easier access to loans for startups. These schemes aim to provide financial support to entrepreneurs, particularly those from marginalized communities, women entrepreneurs, and businesses in rural areas. Below are some of the most prominent government schemes:

1. Pradhan Mantri Mudra Yojana (PMMY)

Launched in April 2015, the Pradhan Mantri Mudra Yojana (PMMY) is one of the most popular schemes for small businesses in India. Under this scheme, loans are provided through three categories:

Shishu:

Loans up to ₹50,000 for early-stage startups.

Kishore:

Loans ranging from ₹50,001 to ₹5,00,000 for businesses looking to expand.

Tarun:

Loans between ₹5,00,001 to ₹10,00,000 for established businesses.

Eligibility: Any Indian citizen involved in non-farm income-generating activities, such as manufacturing, trading, or services, can apply for a Mudra loan.

Application Process: Entrepreneurs can apply for a Mudra loan through any public or private sector bank, regional rural banks, or microfinance institutions. The application requires minimal documentation, making it accessible for small business owners.

2. Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

The CGTMSE scheme provides collateral-free loans to micro and small enterprises, making it easier for startups to secure funding without the need for personal or business assets as collateral. The scheme covers loans up to ₹2 crore.

Eligibility: Both new and existing micro and small enterprises, including those in the service sector, are eligible for the CGTMSE scheme.

Application Process: Entrepreneurs can apply for a CGTMSE loan through participating banks and financial institutions. The loan is processed like a standard business loan, but without the need for collateral.

3. Stand-Up India Scheme

The Stand-Up India scheme is aimed at promoting entrepreneurship among women and marginalized communities. The scheme provides loans ranging from ₹10 lakh to ₹1 crore to at least one woman and one SC/ST borrower per bank branch.

Eligibility: The scheme is open to women entrepreneurs and individuals from SC/ST communities who are starting a new business in manufacturing, trading, or services.

Application Process: Interested entrepreneurs can apply through any public sector or scheduled commercial bank. The application process involves submitting a detailed business plan and other required documents.

4. Startup India Scheme

The Startup India initiative was launched to build a strong ecosystem for nurturing innovation and startups in the country. Under this scheme, startups can avail of various benefits, including tax exemptions, intellectual property support, and easy access to funds through the Fund of Funds for Startups (FFS).

Eligibility: Startups must be registered under the Department for Promotion of Industry and Internal Trade (DPIIT) to avail of the benefits. The company should be less than 10 years old, with an annual turnover of less than ₹100 crore.

Application Process: Startups need to register on the Startup India portal and apply for DPIIT recognition. Once recognized, they can access various benefits, including funding support.

5. National Small Industries Corporation (NSIC) Subsidy

The NSIC provides financial assistance to small and medium enterprises (SMEs) through a range of schemes, including raw material assistance and credit support. NSIC also offers a subsidy for technology upgradation, helping startups enhance their operations.

Eligibility: SMEs engaged in manufacturing, service, or trading activities are eligible for NSIC benefits.

Application Process: Entrepreneurs can apply for NSIC schemes through the NSIC website or by visiting their nearest NSIC branch. The application requires submitting detailed project reports and financial statements.

How to Apply for a Startup Loan

Applying for a startup loan involves several steps, and understanding the process can significantly increase your chances of securing funding. Here’s a step-by-step guide:

1. Assess Your Funding Needs

Before applying for a loan, determine how much funding your startup requires. Consider all aspects, including initial setup costs, working capital, marketing expenses, and contingency funds. Having a clear understanding of your financial needs will help you choose the right loan scheme.

2. Research the Available Schemes

Different government schemes offer varying benefits. Research the available options and select the one that best suits your business needs. Consider factors such as loan amount, interest rates, repayment terms, and eligibility criteria.

3. Prepare a Detailed Business Plan

A well-prepared business plan is crucial when applying for a startup loan. Your business plan should outline your business model, target market, revenue projections, and growth strategy. It should also include detailed financial forecasts, demonstrating how you plan to use the loan and repay it.

4. Gather the Required Documents

Different loan schemes require different sets of documents. Generally, you will need to provide the following:5. Submit Your Application

Once you have gathered all the necessary documents, you can submit your loan application through the designated bank or financial institution. Ensure that all the information is accurate and complete to avoid delays in processing.

6. Follow Up on Your Application

After submitting your application, regularly follow up with the bank or financial institution to check the status. Be prepared to provide additional information or documents if requested.

Benefits of Government Startup Loans

Government startup loans offer several advantages over traditional loans, making them an attractive option for new entrepreneurs:

Collateral-Free Loans: Many government schemes, such as CGTMSE, offer collateral-free loans, reducing the financial burden on entrepreneurs.

Lower Interest Rates: Government-backed loans often come with lower interest rates compared to commercial loans, making them more affordable.

Longer Repayment Terms: These loans typically offer flexible repayment terms, allowing startups to repay the loan over an extended period.

Inclusive Opportunities: Schemes like Stand-Up India promote inclusivity by offering loans to women and marginalized communities, encouraging diverse entrepreneurship.

Supportive Ecosystem: Initiatives like Startup India provide a comprehensive support system, including tax benefits, mentorship, and networking opportunities.

Challenges and Considerations

While government startup loans offer numerous benefits, there are also challenges that entrepreneurs should be aware of:

Eligibility Criteria:

Each scheme has specific eligibility criteria that may exclude certain businesses or individuals.

Lengthy Application Process:

The application process for government loans can be time-consuming, requiring detailed documentation and multiple rounds of verification.

Limited Funding Options:

Some schemes have a cap on the loan amount, which may not be sufficient for businesses with larger funding needs.

Dependence on Government Policies:

Government schemes are subject to changes in policies, which can impact the availability of funds or the terms of the loan.

Success Stories: Entrepreneurs Who Benefited from Government Startup Loans

Several Indian entrepreneurs have successfully leveraged government startup loans to build thriving businesses. Here are a few inspiring stories:

1. Chai Point

Chai Point, a popular tea chain, started with a small loan under the Mudra Yojana scheme. Today, the brand has expanded across multiple cities, offering a range of tea-based beverages and snacks.

2. Wow! Momo

Wow! Momo, a fast-food chain specializing in momos, received financial assistance through the Stand-Up India scheme. The brand has since grown into a multi-crore business with outlets across the country.

3. Paper Boat

Paper Boat, a beverage company known for its traditional Indian drinks, utilized the CGTMSE scheme to secure funding for its early operations. The company has since become a household name, offering a variety of nostalgic beverages.

Conclusion

Government startup loans in India are a valuable resource for new entrepreneurs looking to overcome financial barriers and turn their business ideas into reality.

By understanding the available schemes, preparing a solid business plan, and navigating the application process, startups can secure the necessary funding to grow and thrive.

While there are challenges, the benefits of these loans, including lower interest rates, collateral-free options, and support for marginalized communities, make them an attractive option for aspiring business owners.

As the Indian startup ecosystem continues to evolve, government initiatives like these will play a crucial role in fostering innovation, creating jobs, and driving economic growth.

Whether you’re a first-time entrepreneur or looking to expand an existing business, exploring these government-backed loan schemes could be the key to your success.

Subscribe To Our Newsletter

Conquer your day with daily search marketing news.

Most popular Blogs

How to Start Water Bottle Business in India: A Practical Guide

Starting a water bottle business in India can be a smart and rewarding move. ...

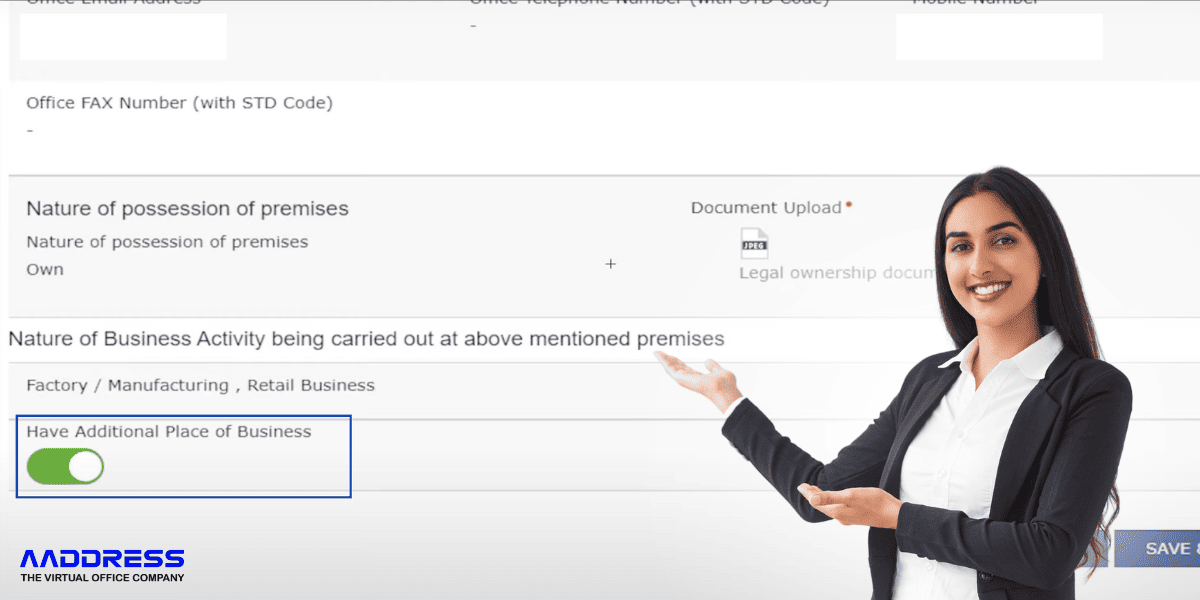

Read Full ArticleReading Time: 4 min.How to Add Additional Place of Business in GST Online (2025 Guide)

Adding an additional place of business in GST is mandatory for each business if they...

Read Full ArticleReading Time: .Low-Cost Business Ideas with High Profit

Introduction Starting your own business is becoming a popular choice for many people today....

Read Full ArticleReading Time: .How to Apply for GST Registration in Coworking Spaces in India

Coworking facilities and virtual offices have become reasonably cheap and flexible solutions as startups, freelancers,...

Read Full ArticleReading Time: .