Don’t just get a virtual office—let us help you build your business with our expert resources.Learn More

How to Apply for GST Registration in Coworking Spaces in India

Coworking facilities and virtual offices have become reasonably cheap and flexible solutions as startups, freelancers, and small businesses keep flourishing in India. Regarding legal compliance—more especially, GST registration—many business owners are not sure how to proceed from such environments.

This detailed guide is specifically for you if you want to register for GST using a coworking space or virtual office address.

Why Would One Want a Virtual Office or Coworking Space?

Understanding why coworking spaces and virtual offices are a game-changer will help one enter the process with knowledge.

- Economical: You don't have to pay for a separate physical office.

- Professional address: Showcase your company in strategic sites.

- Mail handling and meeting rooms: Availability of fundamental office functions.

- Documentation geared at being compliant: Perfect for legal formalities including GST registration.

Let us now explore how to apply for GST registration using these spaces.

Step-by-Step Guide for Applying for GST Registration from a Virtual Office Space

Step 1: Select a Virtual Office Provider with GST Registration

Choose first a reliable virtual office aggregator with GST-compliant paperwork. Aaddress.in, for instance, is known for providing virtual offices across India’s prime business hubs with proper legal documents such as rent agreements, NOC, and utility bills—essential for GST registration.

Step 2: Get Your Documentation in Place

Once you’ve signed up with your supplier, they will give the following documents:

- Rent Agreement

- NOC (No Objection Certificate) from the property owner

- Utility Bill (like electricity bill) in the property owner's name

Ensure these documents are stamped and notarized as per the state’s requirements.

Step 3: Visit the GST Portal

Go to the GST portal. Click on ‘New Registration’ beneath the taxpayer section.

Step 4: Fill in Your Business Details

Provide:

- Your legal business name (must match your PAN)

- PAN card details

- Email ID and mobile number (for OTP verification)

Once submitted, you will receive a Temporary Reference Number (TRN) to proceed.

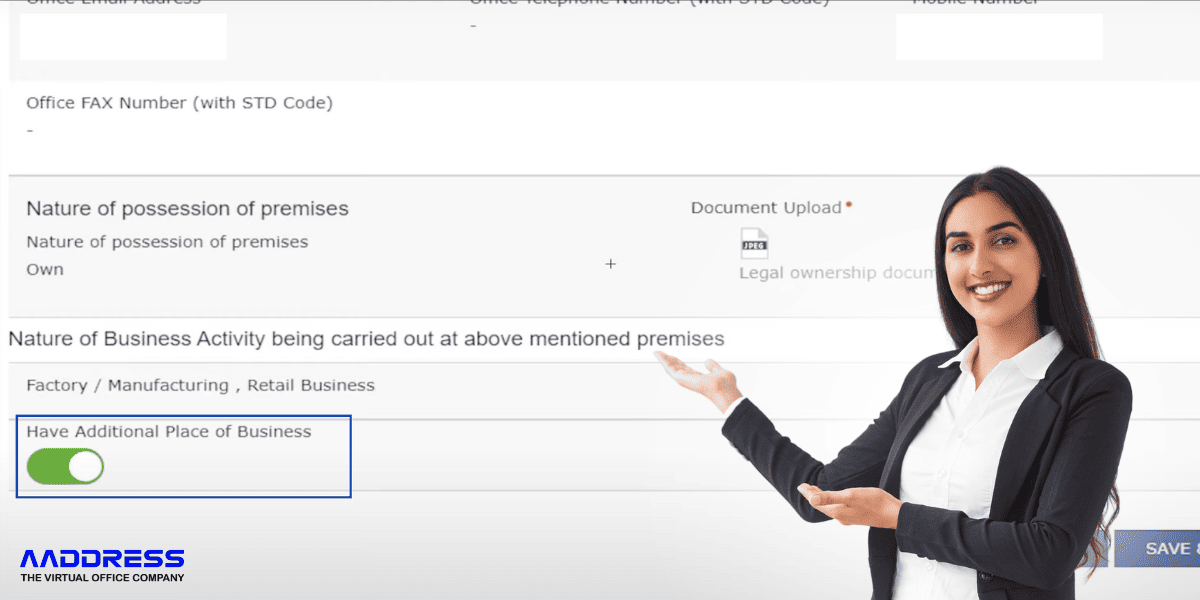

Step 5: Complete Part-B of the Application

Log in using your TRN. Fill in details such as:

- Business Constitution (Sole Proprietor, Partnership, etc.)

- Principal Place of Business (use the coworking space/virtual office address)

- Additional Places of Business (if applicable)

- Bank Account details

- Authorized Signatory details

Step 6: Upload Required Documents

The portal will prompt you to upload:

- PAN Card of the business owner or entity

- Aadhaar Card of the authorized signatory

- Passport-size photograph

- Business address proof (here is where documentation from your coworking space come in helpful)

Step 7: Verify Using Aadhaar Authentication

Use Aadhaar-based e-KYC for quick verification. Alternatively, verification can be done via DSC (Digital Signature Certificate).

Step 8: ARN Generation and Processing

Upon successful submission, you’ll receive an Application Reference Number (ARN). Usually, GST authorities review applications for seven working days.

Step 9: GST Certificate Generated

Once approved, you can download your GST certificate from the portal. Congratulations; now your company is GST-registered!

Benefits of Taking a Virtual Office from Aggregators Like Aaddress.in

1. Pan India Presence: Taking a virtual office from Aggregators Like Aaddress.in allows you to expand without physically moving by using office addresses in major locations.

2. Affordable Plans: Perfect for startups and small businesses, no large rent or overhead charges.

3. GST and Legal Compliance Ready: Among their bundles are utility bills, NOCs, and rent agreements—all required for GST registration.

4. Mail handling and reception: Your business correspondence is expertly handled in mail handling and reception services.

5. Flexibility: Start with a virtual address and as your company expands, upgrade to actual coworking.

6. Meeting Rooms: Pay-as-you-use meeting places when you have to meet team colleagues or clientele.

7. Easy Setup and Support: Simple onboarding and customer assistance free of hassle help to streamline the process.

Final Thoughts?

GST registration through coworking spaces or virtual offices is no longer complicated. Platforms like Aaddress.in have streamlined the process by offering all necessary compliance documents and a prestigious business address at a fraction of the cost of a traditional office. Whether you're a solopreneur, freelancer, or scaling startup, this is an efficient, legally sound, and affordable way to establish and grow your business in India.

Subscribe To Our Newsletter

Conquer your day with daily search marketing news.

Most popular Blogs

Top 5 Locations in Delhi to Set Up Your Virtual Office

When you start a business in Delhi, there's always that one uncle or friend who...

Read Full ArticleReading Time: 5 min.How to Start Water Bottle Business in India: A Practical Guide

Starting a water bottle business in India can be a smart and rewarding move. ...

Read Full ArticleReading Time: 4 min.How to Add Additional Place of Business in GST Online (2025 Guide)

Adding an additional place of business in GST is mandatory for each business if they...

Read Full ArticleReading Time: .Low-Cost Business Ideas with High Profit

Introduction Starting your own business is becoming a popular choice for many people today....

Read Full ArticleReading Time: .