Don’t just get a virtual office—let us help you build your business with our expert resources.Learn More

GST 2.0 Explained: What Will Get Cheaper for Indian Consumers in 2025?

India is about to reform its goods and services tax (GST) since its introduction in 2017. The central government of India says that it will be changed from a four-slab structure to a two-part GST system that is 5% GST and 18% GST.

Additionally, it will set aside a 40% rate for sin and luxury goods. The GST 2.0 can change the household budgets, local enterprises and overall economy of the country.

What impact will the GST 2.0 have on consumers, and which items will become more affordable? Let's discuss in detail.

What will be more affordable after the GST cut?

The biggest question in the mind of the consumer is: what will be cheaper after the reforms? Here is the answer:

1. Daily needs

Packaged items, ghee, and processed milk products are now taxed at 12%. It might get reduced to 5%. It will make kitchen food items cheaper for families.

Also, there might be a drop in the prices of apparels and footwear priced under 1000 INR. It will be a relief to middle-class and rural households.

2. Appliances and consumer electronics

The GST slab may shift from 28% to 18% for electronic appliances such as refrigerators, washing machines, TVs, and air conditioners. For example, if you are buying a washing machine costing 30,000 INR, it will incur a GST of 28%.

Which means you will pay an additional 8,400 in the current GST. Under GST 2.0, that would be reduced to 5,400 INR, and you would save 3,000 INR.

3. Vehicles

Cars that are small with engine capacity up to 1200 cc might move from the 28% GST to 18%. This change will result in a significant drop in the on-road prices of cars. Two-wheelers may also get the benefits of GST reform, leading to a boost in sales in semi-urban and rural consumers.

4. Insurance

The GST 2.0 might shift the insurance premium from the current 18% slab to 5%. In some cases it might be completely removed. This change might prove to be the most consumer-friendly move for GST 2.0. These changes will directly help each and every household with life, health, and motor insurance, reducing yearly financial burdens.

5. Cement and construction

The most heavily taxed goods and materials as of now are construction goods and cement. It might get shifted from the 28% to the 18% bracket. The change will directly impact real estate and people looking forward to building and renovating houses.

How will GST 2.0 impact local businesses?

Local and small businesses like retailers and MSMEs will benefit significantly from GST reforms.

Simplicity: Simplifying compliance, including fewer slabs, will reduce the complexity of accounting.

Revenue Boost: Lower GST means lower prices, which in turn means more sales and revenue.

Economic advantage: Improved competitiveness with larger businesses due to price normalization.

With benefits will come some risk too; they are as follows:

- State government may oppose the reform due to heavy financial losses.

- Businesses may face anti-profiteering regulations which ask them to pass tax benefits to their customers.

- Without strict implementation, customers may not see any price reduction.

Overall impact on the economy

Inflation: Experts expect that GST 2.0 will reduce inflation by 20 to 60 basis points. It will provide some room for the Reserve Bank of India to consider a rate cut.

Government revenue: Though the central exchequer might lose some money in the short term, a smooth arrangement can improve compliance and increase the tax base in the long term.

Consumer Sentiment: Reduced prices on daily needs and luxurious goods like cars and electronics will boost the confidence of the common man ahead of the festive season.

Conclusion

GST 2.0 is more than just a tax reform; it represents a shift towards lowering the prices of goods and services, increasing sales, and simplifying compliance for businesses.

For the general population of the country, GST 2.0 means lower prices on everyday necessities as well as electronic and luxury items. For small businesses it means more sales and less complexity of accounting. For the overall economy, it may result in a short-term loss of revenue for the government, but it is expected to lead to long-term growth.

Diwali 2025 is coming soon, so we might expect these reforms to roll out. Consumers may save some money, and local businesses might finally get the festive sales boost they've been waiting for.

Subscribe To Our Newsletter

Conquer your day with daily search marketing news.

Most popular Blogs

Top 5 Locations in Delhi to Set Up Your Virtual Office

When you start a business in Delhi, there's always that one uncle or friend who...

Read Full ArticleReading Time: 5 min.How to Start Water Bottle Business in India: A Practical Guide

Starting a water bottle business in India can be a smart and rewarding move. ...

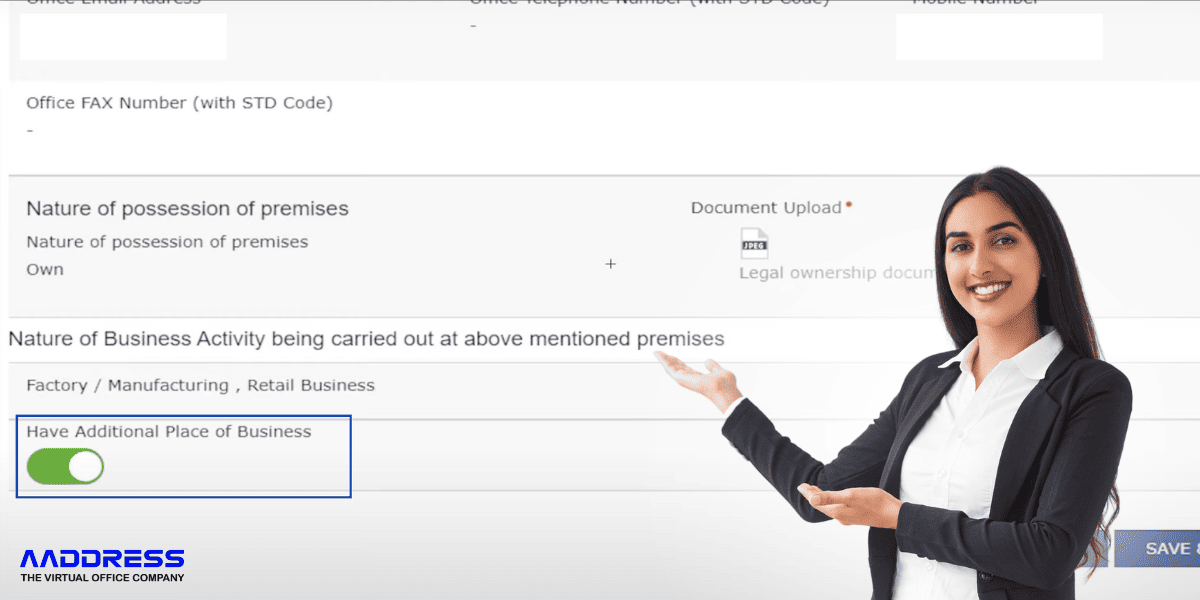

Read Full ArticleReading Time: 4 min.How to Add Additional Place of Business in GST Online (2025 Guide)

Adding an additional place of business in GST is mandatory for each business if they...

Read Full ArticleReading Time: .Low-Cost Business Ideas with High Profit

Introduction Starting your own business is becoming a popular choice for many people today....

Read Full ArticleReading Time: .